Home / Blog / Top Risks in the Mining Industry 22/23

Top Risks in the Mining Industry 22/23

Published: 13th October 2022

The mining industry has once again faced many challenges this year, with a major one again being the microscope the industry has been put under for its male-dominated culture. This year’s Australian Mining Risk Forecast has been recently released by KPMG and it’s an interesting read on what is top of mind for mining executives.

Top industry risks

Cybersecurity

Ironically this years KPMG survey has seen cyber security fall from the Top 10 list of Industry Risks, however with the Optus Data Leak making headlines recently we are sure this will be at the top of some executive’s minds. Although its dropped from the top 10 it is still highlighted in the report with experts pointing out that this may be a case of cyber fatigue due to the industry hyping up the risk for so long without a major attack on the mining industry. The report also points out that it may also be due to companies already increasing their security during the pandemic. However with cyber attackers still getting smatter this is a threat that is bound to creep up into the top 10 once again.

New Risks – Decarbonisation and War for Talent

There are two new risks that have appeared on the list in top positions. Firstly Financial risks in decarbonising the value chain and secondly, the war for talent, driven by the need for new talent with more specialised skills to step into the industry as it moves to needing more technology focused roles.

In KPMG’s report, 87 percent of executives who completed their survey believe that technology will play a key role in solving ESG challenges. Adoption of new technologies and innovation are believed to be the major disruption in the industry in the next three years, with most executives seeing this as an opportunity rather than a threat. Electric powered trucks as well as renewable energy sources would significantly impact a company’s carbon output.

Already miners are embracing future technology with drone technology becoming more popular for surveying, sensors are being used to monitor workers fatigue levels to improve health and safety and more data is being collected to make more informed decision making. However this new technology goes hand in hand with the war for talent, in that the industry doesn’t have skilled workers to currently transition to these more technology focused roles.

Downward trending Risks – Community relations and social license, Global pandemic and Economic Downturn.

Community relations and social license to operate have dropped down from 2nd to 4th, along with the Global pandemic dropping from 3rd to 6th and Economic downturn dropping from 5th to. Mining executives are also showing less concern about having access and the retention of employees, possibly due to realising they can run a more productive workforce through optimising their time.

Other Risks – Supply Chain and Political instability/ nationalisation.

It should be no surprise that the industry is still worried about the Supply chain risk, as we still suffer the delays in getting parts and materials while the manufacturing industry tries to play catch up. Political instability/ nationalisation has also increased, with the KPMG survey happening before the war in Ukraine started. Environmental risks, including new regulations have also ascended up the list as the impact the mining industry has on the environment has grown on people’s minds.

What we are Seeing

At Scope we are seeing more clients investing in people management applications to have greater control over their workforce and scheduling. There has also been the realisation that a more automated workflow solutions is the way forward, helping to reduce unnecessary admin hours.

We’ve had a number of clients shift their data onto our cloud solution, with many customers choosing it for the added layer of security and maintenance that our cloud solution offers.

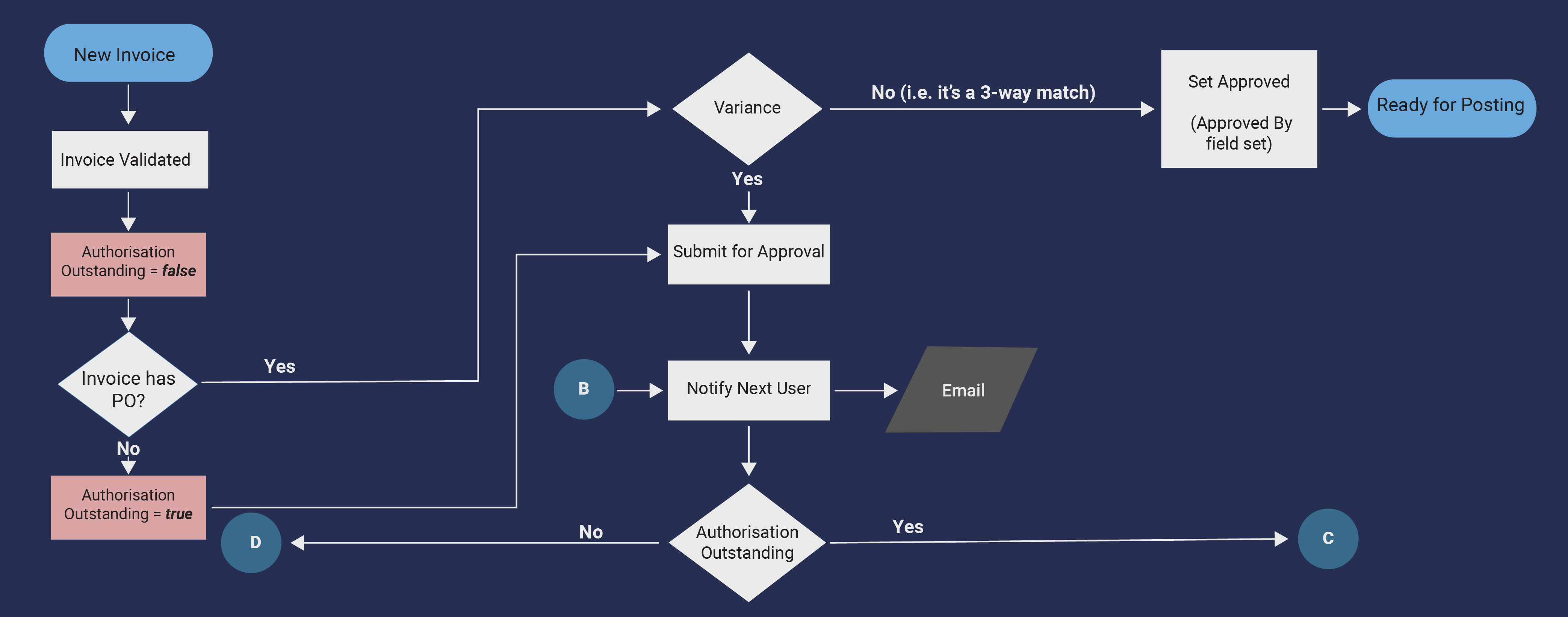

There has also been a bigger push in companies investing in Business Intelligence solutions with a stronger focus on data driven decision making in all areas. This has also lead into companies wanting more from their solutions and are looking for more integrated, streamline solutions with the popularity of AP invoicing on the rise with Peppol eInvoicing coming into the forefront this year.

In Summary

Our customers are expecting more integrated solutions across their businesses in an attempt to reduce administration hours and reliance on staff for menial tasks, instead looking at automated solutions. People management software has also had an increase in interest this year, probably encouraged by the war on talent. Even though miners area less worried about retaining employees this is most likely mitigated by proper scheduling.

In conclusion, companies are relying on technology now more than ever to reduce load on their staff, organise their workforce efficiently and to drive their decision making process. We think there will be a big focus on having integrated systems in the next few years as well as reducing the number of hours spend on admin tasks through automated processes such as Peppol.